Securespend com- Are you a shopping addict? Then I guarantee you Securespend article is going to benefit you a lot. Nowadays, everyone shops by using either their credit card or debit card. These transaction cards allow a shopper to shop freely without thinking of anything else. As credit and debit cards, Securespend cards are introduced. A Securespend card is a prepaid card. Lets dig into further detail of Securespend card.

Securespend card can be used for shopping, dining, at petrol pump stations, and online shopping as well. This card ensures you full security by concealing your identity and other information at the time of purchase.

Securespend cards can be used for small as well as large purchases. You can pay a huge amount with this card as well. This card is accessible in many outlets as well as restaurants to ease online payment. Securespend cards are available at many retail outlets.

What is a Securespend card?

Secure spend is a prepaid card which means it is essential to load money into the card before you use the card. This card is non-reloadable. Securespend card is available at many stores from where you can buy this card and use it. This card is for 4.95 dollars.

There are no other charges for this card. The most satisfactory thing about a secure spend card is this, your personal information will not be revealed even at the time of purchase. It is very effortless to make payments from a secure spend card. But you cannot use the Securespend card at ATMs and cash backs. You need to set a pin code for operating a Securespend debit card. This pin code will be required at the time of purchase.

Read also: ii Login Guide

Advantages of using a Securespend card:

A secure spend card is different from the rest in many features. The benefits of choosing a secure spend card over others are the following;

- A secure spend card is easy to operate.

- A secure spend card hides your card number and other information at the time of payment.

- This card provides strong security.

- This card can be used almost everywhere such as in retail outlets, grocery stores, petrol stations, malls, and restaurants as well.

- The customer support team is active 24 hours a day, 7 days a week. They guide the customers on how to operate and help them solve any problem.

- You can also pay your bills online with a secure spending card.

- This card can be loaded on the same day as it was bought.

How to create an account on Securespend.com?

you can create your Securespend com online account by following these steps;

- Enter your email.

- Create your password.

- Confirm your password.

- Add security question.

- Add an answer to that security question.

- And Add another security question and similarly its answer.

- Now click on ‘next’.

- Add your card details in the next step.

- Confirm your provided information.

- Your account will be created at this step.

(Note: the password that you are creating must contain eight characters. This must include an uppercase character, a lowercase character, one number, and one special character.)

The security questions that you are adding must be accurate.

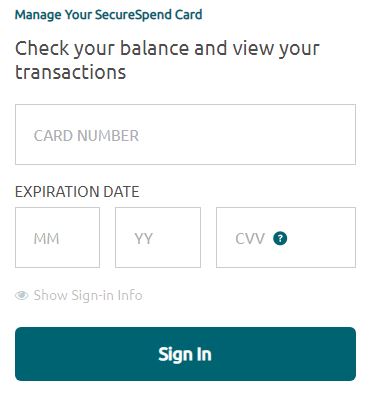

How to log in to a Securespend com card account?

It is very simple to log in; you just need to enter this information;

- Your Card Number.

- Card Expiration date.

- Card Verification Value (CVV).

- Click on ‘sign in’.

Read also: DGme login Step by Step guide

How to make purchases by using Securespend card:

- First of all, select the “credit” or “debit” option. If you have chosen the debit option then you must set a pin for your card.

- Each time you use your card, taxes and other charges will be deducted from your card along with the amount of the purchase.

- Make sure that your Securespend card has enough balance for your purchase otherwise it will be denied.

- In case, you want to use two methods of payment, you must inform the dealer before operating the card.

How to check Securespend card balance:

You can check your Securespend card balance by providing the following details;

- Open the Securespend.com website on your PC or smartphone.

- Click on the option “check your balance and transactions”.

- Then enter your card number without spaces.

- Enter your card expiration month.

- Also, enter your card expiration year.

- In the next option, enter your card security code.

- Click on the “GO” option.

(Note: The card security code is the last 3 or 4 digits mentioned on the signature box on the back of the Securespend card.)

How to activate a Securespend card:

There is not a hard rule for activating Securespend cards. You can activate your Securespend card anytime by these steps;

- To activate Securespend card, go to any local retailer.

- Choose the amount you want to load. Extra charges may be applied.

- Open the Securespend.com website on your smartphone or PC and register there by adding card information.

- Now you can use your card for the purchase.

Securespend.com privacy policy:

The Securespend card has high privacy. The customer’s necessary details such as card number and name are protected. Unlike other debit cards, customers’ details will not be disclosed while making payments through a Securespend card. It also has a card security code that is necessary to check balance and log in.

Important instructions to use the Securespend card:

- Before purchase, you must make sure that your Securespend card has enough balance that is sufficient for your purchase plus taxes.

- Sometimes, a 20 percent holdup is required to operate the Securespend card for the payment.

- In payment methods, you must choose between credit and debit cards. Don’t choose the gift card option.

- For online payment, Mention card details in the payment method as well.

- Enter your full name and address in the billing address section.

Securespend retailers:

You can buy your Securespend card from any of the following outlets. Here is the list of Securespend com retailers;

- Walmart.

- Walgreens.

- Dollar general.

- 7 eleven.

- Family dollar.

- Speedway.

- Xchange.

- CVS pharmacy.

- Rite Aid Pharmacy.

- Sam’s Club.

- HEB.

- Circle K.

- Fred’s.

- Food city.

- Sheetz.

- DuaneReade.

- Associated Food Stores.

Limitations of Securespend Card:

This card cannot be used for the following services;

- You cannot use this card at ATMs.

- Your refunds that the dealer or shopkeeper credits to your card may not be transferred immediately.

- You cannot pay recurring or subscription bills from Securespend Card.

- This card will not be operated if you don’t have the load more than the combined amount of your purchase rate and tax rate.

Securespend com Customer Helpline:

Team Securespend is available 24 hours 7 days a week to guide its customers. Their team resolves every problem of the client. Even if your card is lost, you can seek help from Securespend customer support team.

- Their helpline number is 1-833-563-8200.

- Their mailing address is;

• PO Box 826

•Fortson, GA 31808.

Securespend Com Conclusion:

Securespend cards are the securest cards. Users have shared good reviews about this card. This card relieves the customers from all stress related to using credit or debit cards. The customer’s private details are protected. It is very convenient to operate a Securespend card for all types of transactions. You can even use this card for online payments in that case you have to enter your name and address in the billing address section.

Users are very happy and satisfied with the Securespend card and its service. Moreover, you can contact the Securespend com customer support team if you face difficulty in operating the card. Their customer support team is open 24 hours 7 days a week. This article contains all the information about the Securespend signup, login, and activation process. Read this article from the start to know everything about Securespend cards.

Securespend Com FAQS:

Q1. What is a Securespend card?

Securespend cards are the most famous cards in the market presently. You can buy the card from the retailer. You can choose for yourself how much money you want to load into this card. These cards are usually available in retail stores from where you can buy them. Securespend cards activate within a few minutes right after the purchase.

Q2. Where can I use the Securespend card?

You can use a Securespend card in shopping outlets, grocery stores, and restaurants. Choose the debit card option and enter the pin code. Pin code should be set at the time of purchase. You can also use a Securespend card for online shopping.

Q3. When Securespend card was launched?

Securespend cards were first made by Comenity Bank N.A. in 2003. Later in 2014, Synchrony Bank obtained these cards.

Q4. How to contact the Securespend com customer support team?

You can call on this number at 1-833-563-8200. Else, you can mail it to the following address;

PO Box 826

Fortson, GA 31808.

Q5. Securespend card is accessible in which region?

Securespend card is valid in the United States and the district of Columbia.

Q6. How much are the Securespend card fees?

Securespend card fee is 4.95 dollars. These are the fees at the time of purchase. This card does not have any annual charges which is a huge benefit of using a Securespend card. You can load the money between 20 dollars to 500 dollars.

Q7. Can I send money to another Securespend card?

No, you cannot send money from one Securespend card to another Securespend card.

Q8. What should I do if my card is lost or stolen?

If you ever lost your card or your card is stolen, you must contact the customer support team. You need to notify the team immediately and within 60 days you can inform them. Otherwise, if you will inform them after 60 days, they will not take any action.

You must inform them if any false transaction has been made from your account without your consent. If you will inform the customer support team timely, they will issue a replacement card to you. Your funds will be transferred to a replacement card. Replacement card will be issued to you within 30 days.